Comparative Market Analysis

The CMA

- Estimating the value of the subject property requires looking at all the market activity of comparable properties. The fewer comparable properties we have to look at, the harder it is to come up with an accurate estimate of value.

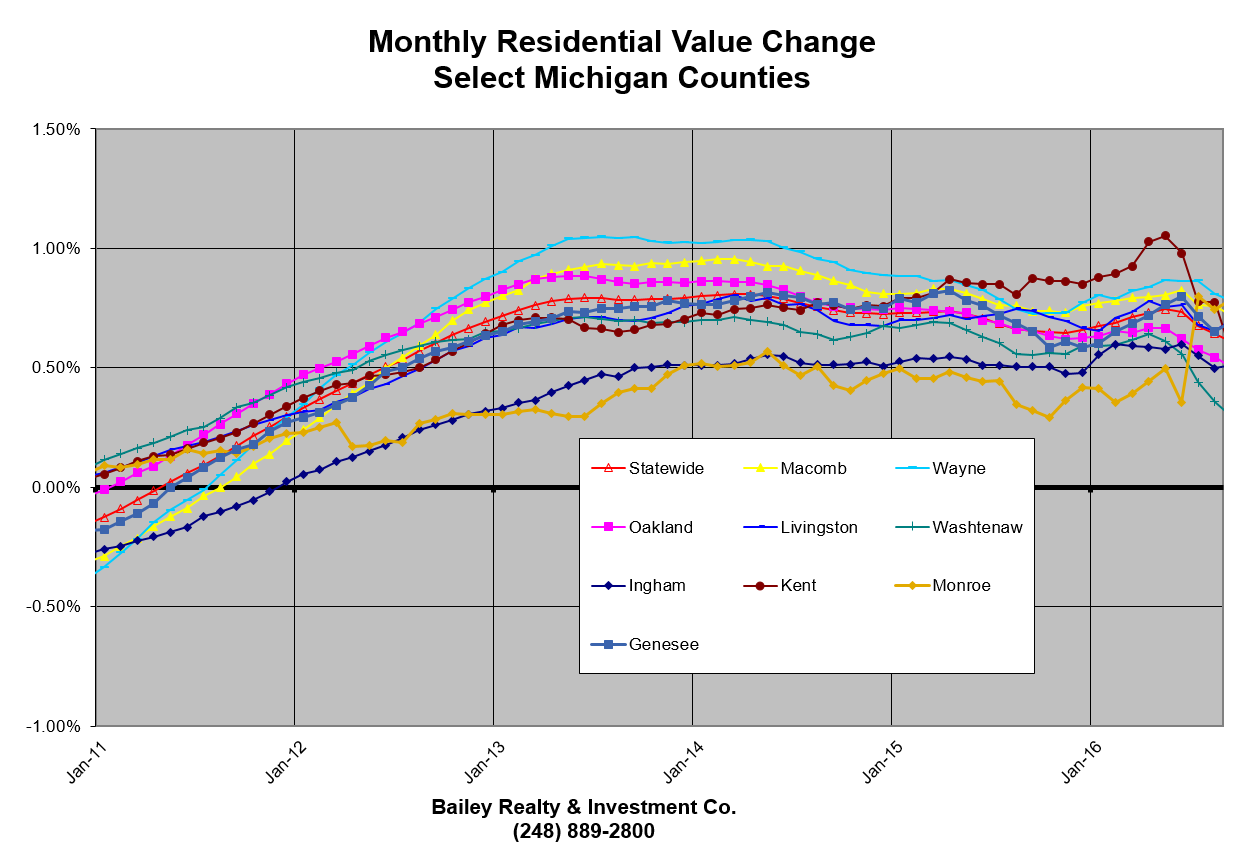

- We calculate and maintain a market index for most communities in our market area. Using this index, we can update older sales to today's dollars. The graph to the side/below shows recent residential market changes for selected counties and the state of Michigan.

- We then look at the comparable sold (brought up to today's dollars), pending and active listings and adjust each to make them look as similar to the subject property as we can. For example, if a comparable sold had 100 more square feet of living area than the subject property, we would subtract $9,000 from that comparable sold (100 sq.ft. x $90/sq.ft.) to get a more comparable estimate for the subject property value.

- We will show you the adjusted comparable dollars for each comparable sold, pending and active listing and come up with a quantitative framework of values. We will discuss with you the qualitative factors of the subject property to see where in that framework the subject property best fits. Most of the time, this will give a very accurate estimate of value for the subject property.

- Will will also look at how much of a buyer's or seller's market using real sales data; not just Realtor intuition.

- Using this estimate of value, market activity, and your particular needs and desires (quick sale, or sale at the best price), we can mutally arrive at a list price (seller) or offering price (purchaser).